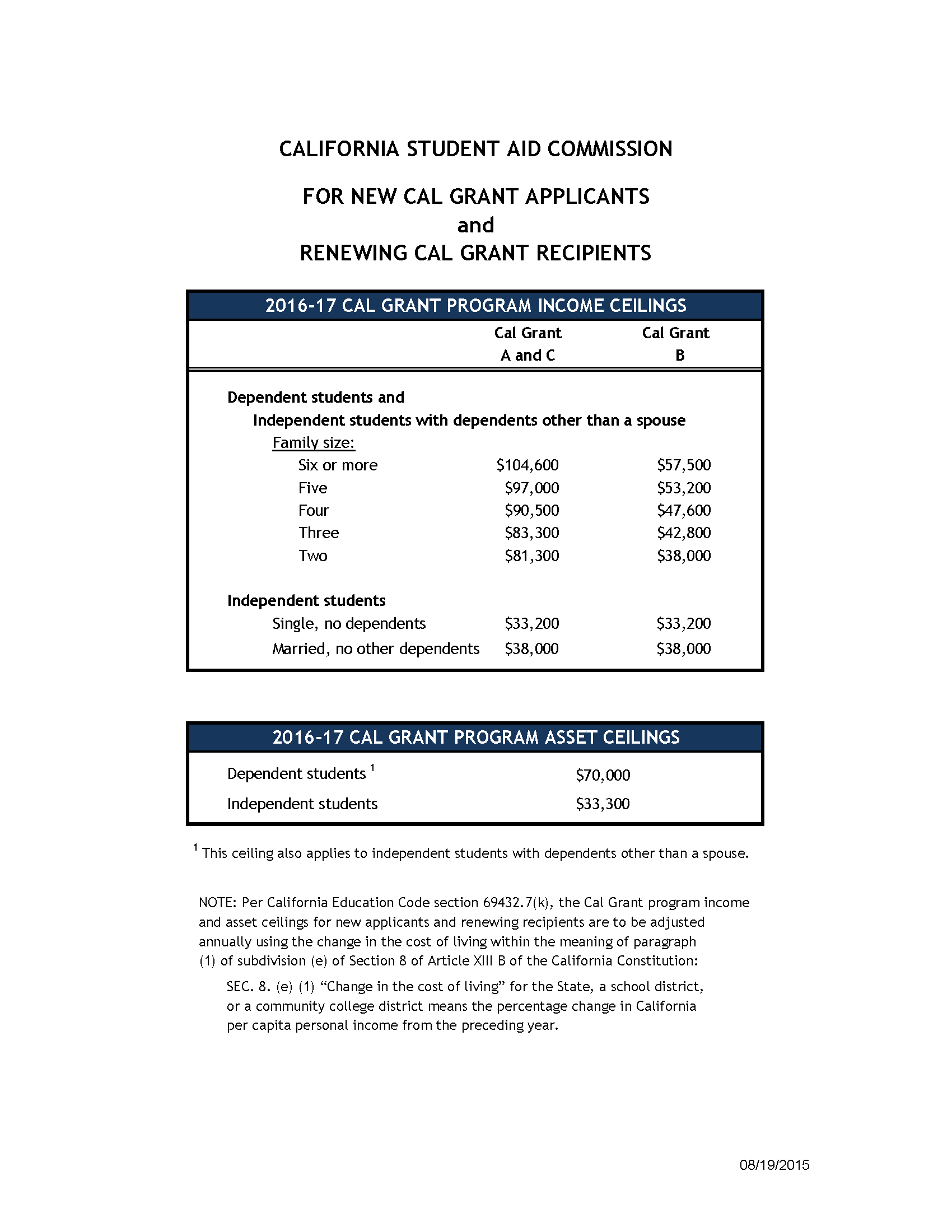

2016-17 Cal Grant Income and Asset Ceilings

Here are the 2016-17 Cal Grant income and asset ceilings. The Cal Grant is income, asset and GPA based. Check the respective family size. The income includes taxable (adjusted gross income) and non-taxable income (i.e. pre-tax contributions towards retirement accounts).

Common Mistake: parents assume it’s just their taxable income they take into account.

You need to be below the income ceiling for the family household size and below the “countable asset” ceiling for the household assets. (all non-retirement, personal assets: checking, savings, stocks, bonds, mutual funds, money market accounts, CDs, 529s, equity of any investment properties).

Other items to complete in order to qualify for the Cal Grant:

1. Submit the FAFSA before March 2nd.

2. Ask your child’s high school counselor to submit their GPA verification form to the California Aid Commission before the March 2nd deadline.

3. Create an account to check your student’s Cal Grant Status: https://mygrantinfo.csac.ca.gov/